April in Taiwan

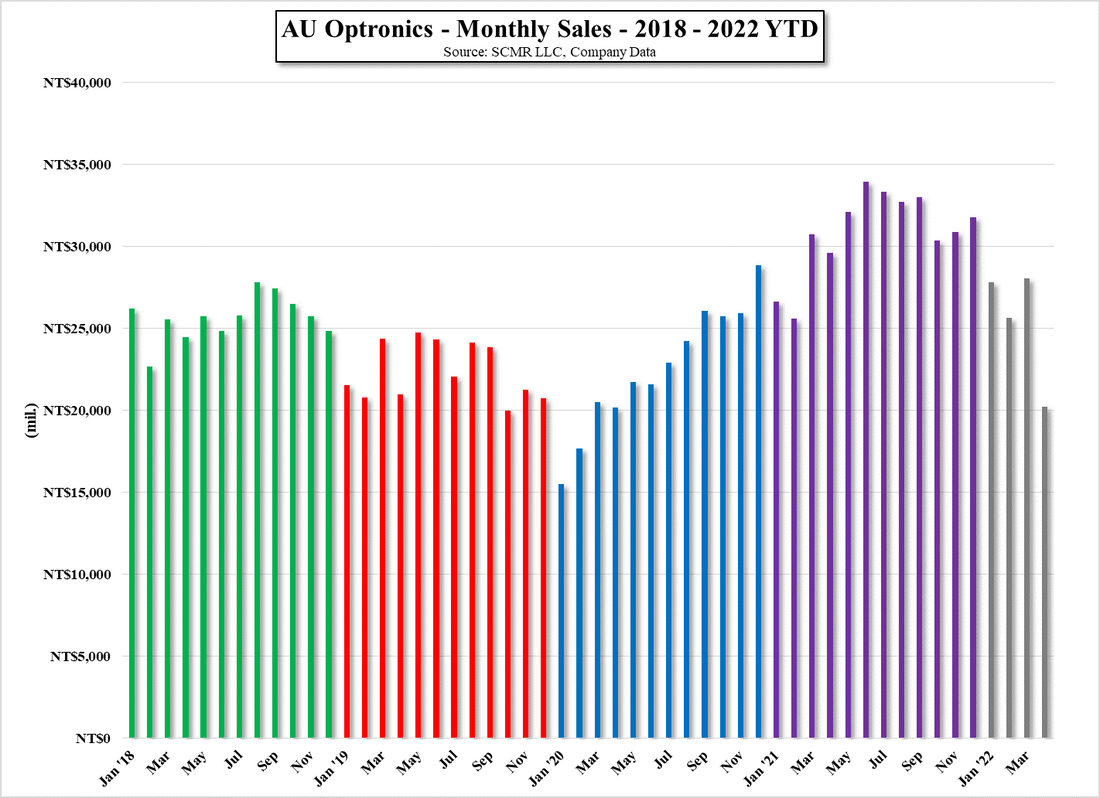

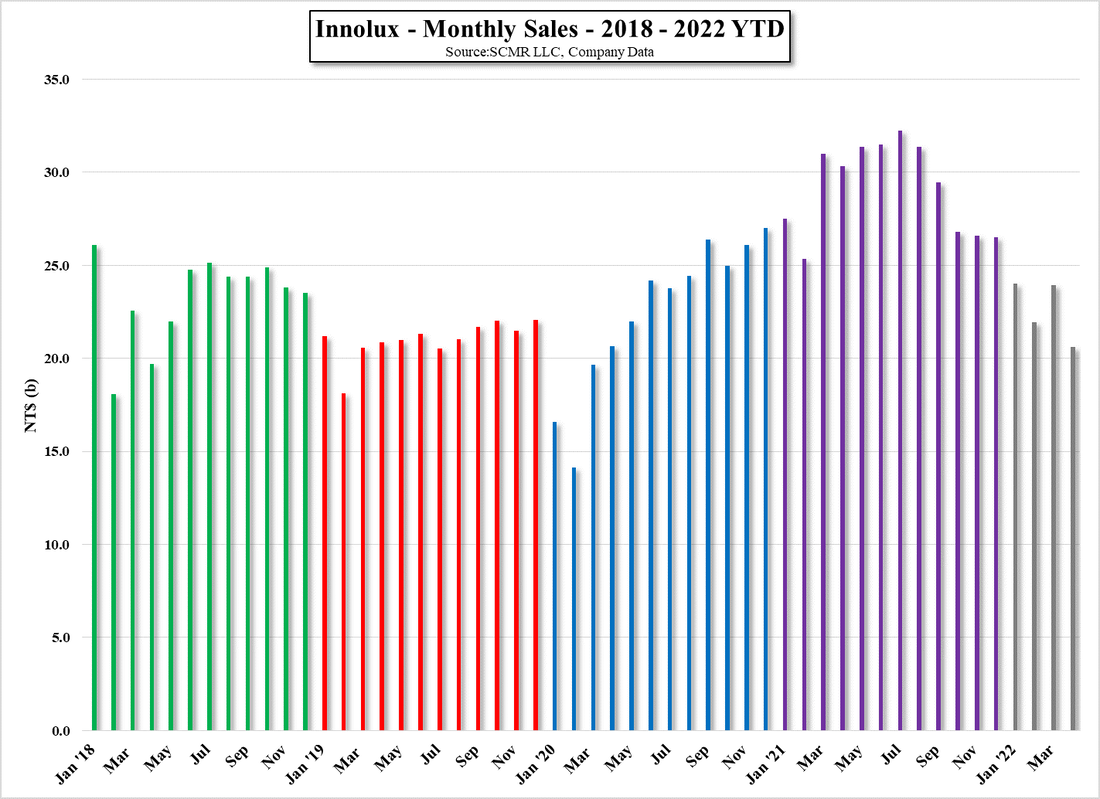

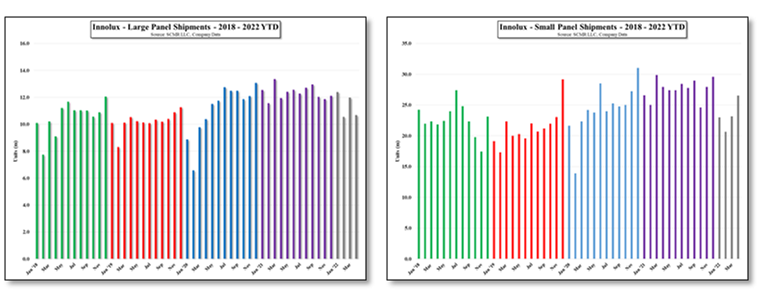

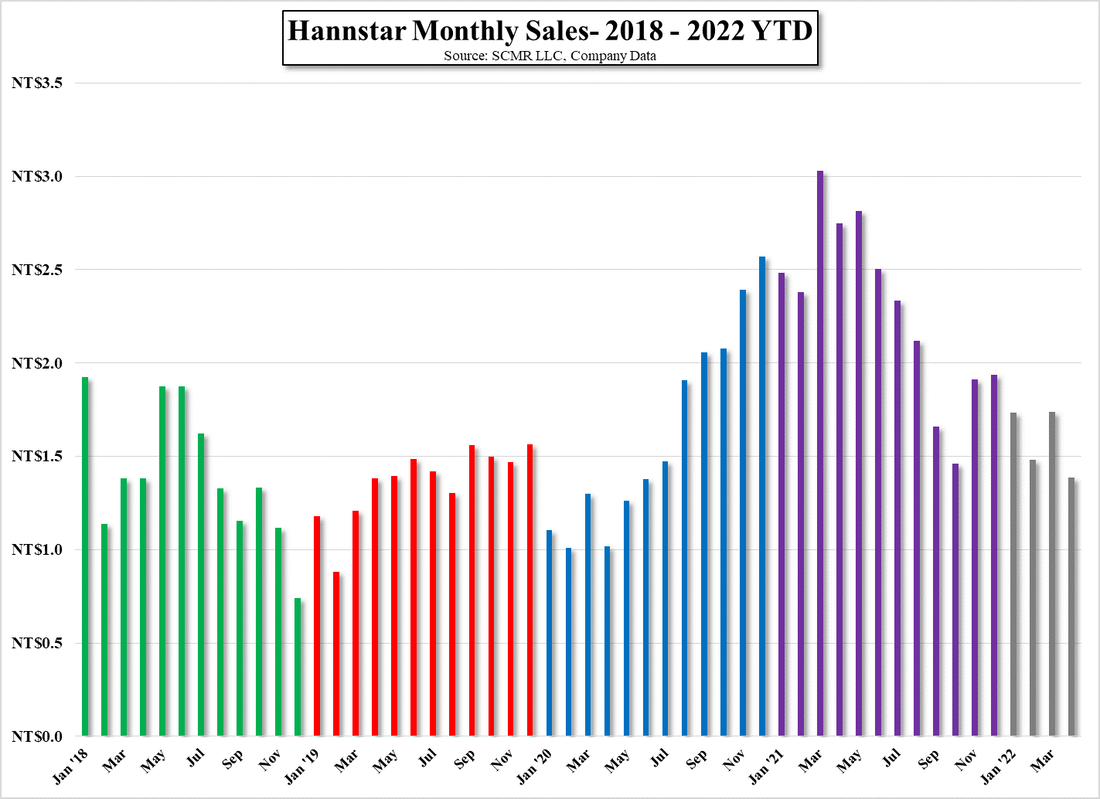

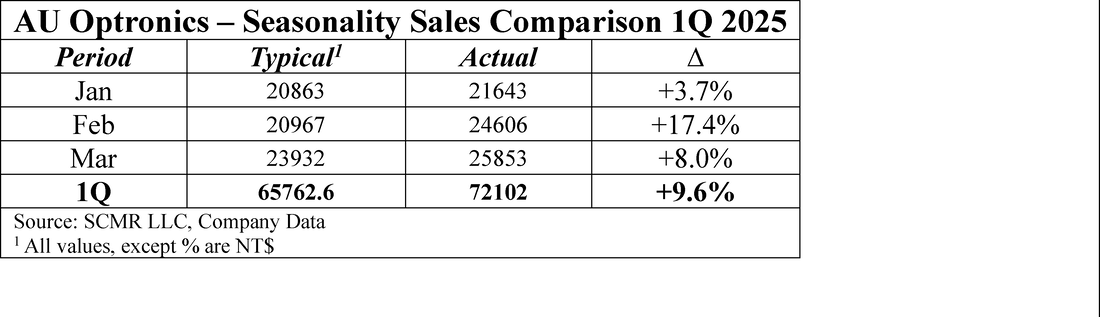

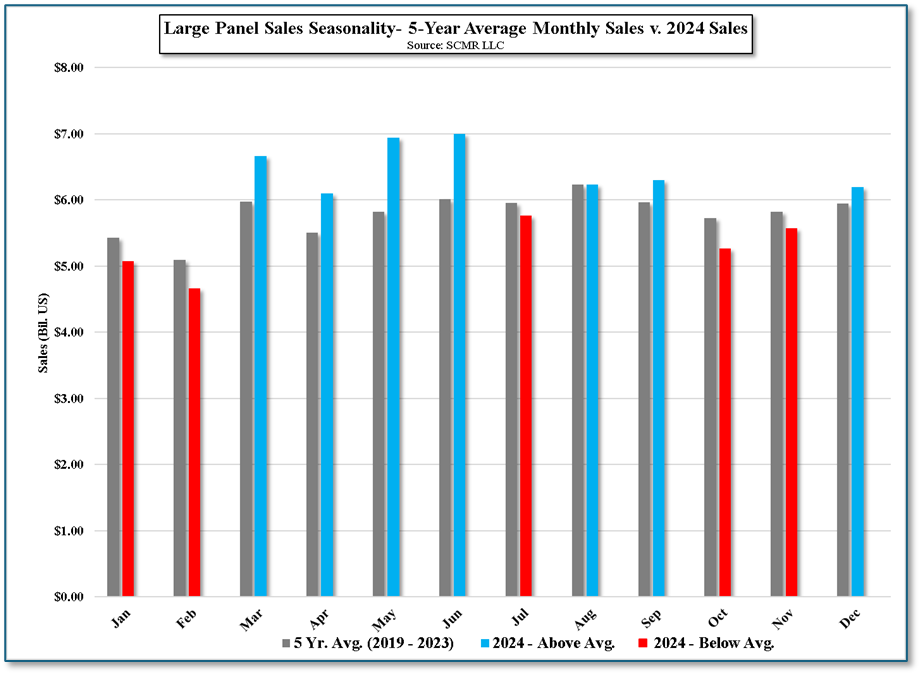

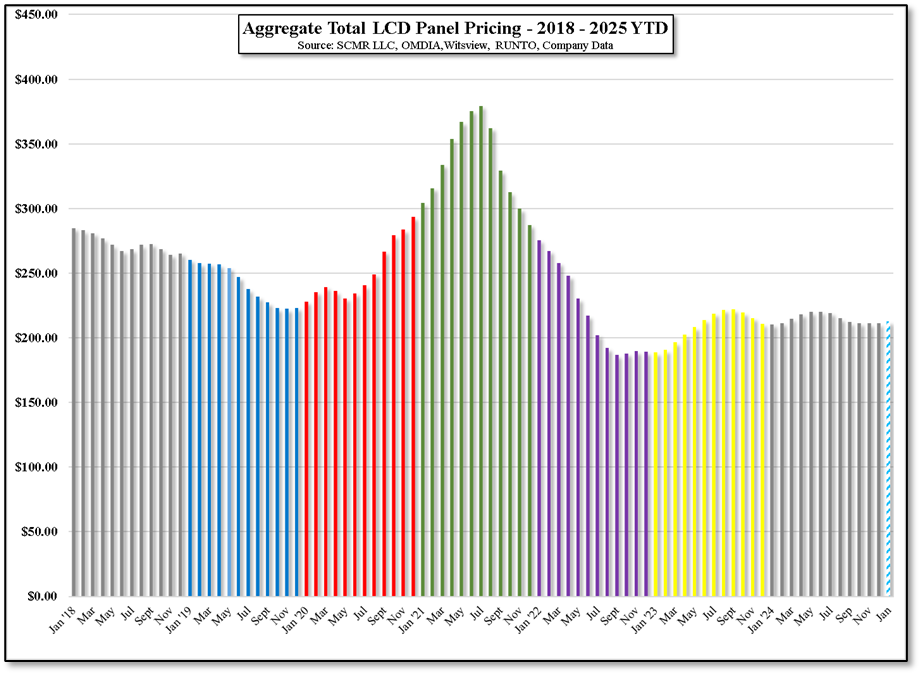

While each of the three producers have their own sales patterns, the general trend last year was for a weak 1Q and progressive improvement through September. This will make y/y comparisons more difficult going forward this year, which have already turned negative for both large panel producers. As we have noted, there has been some non-linearity this year as CE brands pull in orders to move product into the US to avoid potential tariffs, which we expect will continue until the next ‘tariff deadline’ in early July. Inventory levels in many CE products remain high for the same reason, which could affect production later in the year if there is no incremental demand as the holiday season unfolds in September.

RSS Feed

RSS Feed